During the trading session that took place on Friday, the Indian stock market witnessed a decline in its indices such as Nifty and Bank nifty and also equities. This decline was primarily attributed to the financial sector, which faced challenges due to a decision made by the central bank. The central bank’s move aimed to tackle the excess liquidity in the market and involved implementing measures such as increasing the cash reserve ratio (CRR) requirement for banks. This decision had a notable impact on the financial sector’s performance.

Simultaneously, another factor contributing to the decline was concerns related to the near-term prices within the domestic market. These concerns caused losses in consumer stocks. Despite some optimism stemming from a decrease in U.S. inflation, the majority of sectoral indexes experienced losses. Specifically, ten out of thirteen major sectors saw declines, and the financial components of these sectors registered a decline of up to 0.52%.

This downward trend was consistent with the pattern observed in the previous trading session. During that session, financials also encountered difficulties due to a directive from the Reserve Bank of India. This directive required banks to allocate a larger portion of their incremental deposits to the CRR. This move aimed to address the surplus liquidity in the market.

Looking ahead, the months of August and September typically face seasonal constraints on liquidity. This is influenced by various factors such as outflows during the festive season and collections of advance taxes. As a result, this liquidity tightening may present temporary challenges for institutions engaged in wholesale financing.

Furthermore, there was a 0.6% decline in consumer stocks, amplifying the losses that had occurred in the previous trading session. The Reserve Bank of India’s concerns regarding near-term inflation played a role in this decline. Additionally, the bank’s revision of the retail inflation forecast for the fiscal year 2024 contributed to the downward trend. The cautious approach taken by the Monetary Policy Committee (MPC) and the absence of indications for a potential rate cut by the end of the year influenced market sentiment in a negative manner.

In a different sector, the pharmaceutical industry saw a decline of over 1%. This decline was attributed to dips in the stocks of companies like Biocon and Alkem Laboratories after they reported their earnings. On the other hand, HCLTech recorded gains of up to 4.64%, making it the top gainer within the Nifty 50 index. This surge in HCLTech’s stock price followed an announcement about a strategic global partnership with Verizon for managed network services.

As of the current day, both benchmark indices have experienced losses of more than 0.25% over the course of the week. This trend suggests that the downward trajectory might extend for the third consecutive week. While the Asian markets remained relatively subdued, equities on Wall Street showed slight gains. These gains were supported by data indicating a moderation in U.S. inflation.

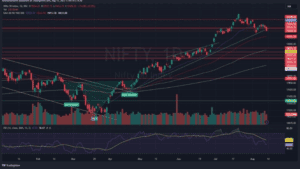

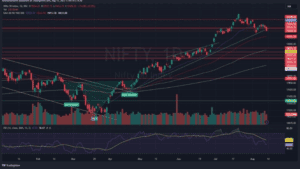

From a technical analysis perspective, the Nifty index displayed a bearish trend on both daily and hourly charts. This was evident from the continued selling pressure and the breakdown from the previously formed inside bar pattern. The presence of negative crossovers in both daily and hourly momentum indicators added to the indication of downward momentum. As a result, it is anticipated that the Nifty index might target levels around 19150 due to the sustained selling pressure. In terms of support and resistance, the range of 19350 to 19300 is identified as key support on the downside, while resistance is expected between 19550 and 19640.

The recent breakdown of the inside bar pattern, observed in the Nifty index, marks a significant technical shift. This breakdown signals a departure from the consolidation phase and suggests a transition towards a bearish trajectory in market sentiment. Traders and analysts closely monitor such pattern breakdowns, as they often signal changes in the supply and demand dynamics.

The bearish outlook is further supported by the negative crossover in both the daily and hourly momentum indicators. This alignment strengthens the likelihood of a continued bearish trend in the Nifty Index. Traders are advised to remain attentive to any signs of divergence or stabilization in these indicators. Such signs could potentially indicate a change in the direction of the trend.

Taking into account these technical indicators, it is anticipated that the Nifty index will aim for approximately 19150, further emphasizing the bearish sentiment. This forecast is consistent with the current momentum and underscores the potential for an ongoing downward trend. It’s important to note that the support zone ranging from 19350 to 19300 holds significance as it could act as a barrier against further downward movement. On the upside, resistance levels between 19550 and 19640 are likely to pose challenges for any potential recovery.

Traders and investors are urged to closely monitor not only the index’s price movement but also its interaction with moving averages, trading volume, and other key technical indicators. This analysis should be conducted within the broader context of market sentiment, taking into account both internal technical factors and external macroeconomic influences to gain a comprehensive understanding of the situation.