What is Initial Public Offerings?

In the world of finance and investment, IPO, which stands for Initial Public Offering, holds significant importance. It marks a crucial stage in a company’s growth, transforming it from a privately held entity to a publicly traded one. In this article, we will delve into the ins and outs of Initial Public Offerings, exploring their meaning, purpose, advantages, and disadvantages.

The Purpose of Initial Public Offerings

At its core, an Initial Public Offerings serves as a means for companies to raise capital from the public. By offering shares to investors, the company gains access to a broader pool of funds, which can be used for expansion, research, development, debt repayment, and various other strategic initiatives.

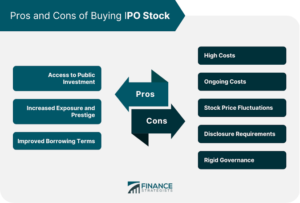

Advantages and Disadvantages of IPOs

Advantages:

Access to Capital: Through Initial Public Offerings, companies can raise substantial funds that can fuel their growth and expansion plans.

Enhanced Reputation: Going public often enhances a company’s reputation and credibility in the market, attracting more customers, partners, and talented professionals.

Liquidity for Shareholders: Initial Public Offering provide an exit strategy for early investors and employees, offering them a chance to sell their shares and realize their investment gains.

Disadvantages:

Loss of Control: Public companies face the challenge of balancing the interests of shareholders, which may lead to diluted decision-making control for the founders.

Increased Regulatory Compliance: After going public, companies must adhere to strict regulatory requirements, which can be time-consuming and costly.

Short-Term Focus: The pressure to meet quarterly expectations may push companies to focus on short-term gains, potentially sacrificing long-term strategic vision.

IPO Process and Steps

The Initial Public Offerings process involves several steps, each requiring thorough preparation and diligence.

Pre-IPO Preparation:

Before initiating an IPO, the company must assess its financials, governance structure, and market positioning to ensure readiness for public scrutiny.

Due Diligence:

Conducting extensive due diligence is crucial to identify potential legal, financial, and operational risks that may affect the IPO process.

Prospectus Filing:

The company prepares a prospectus, providing detailed information about its business, operations, financials, and risks to potential investors.

Underwriting:

Investment banks play a crucial role in underwriting the IPO, helping the company determine the offering price and managing the allocation of shares.

Roadshow:

During the roadshow, the company’s management presents its business to potential investors, aiming to generate interest and demand for the Initial Public Offerings.

Pricing and Allocation:

The final offering price is determined based on investor demand, and shares are allocated to institutional and retail investors.

IPO Performance and Metrics

Post-IPO, the company’s performance is closely monitored by investors and analysts. Key metrics include post-IPO share price performance, market capitalization, and the IPO success rate.

Post-IPO Share Price Performance:

The share price performance in the days, weeks, and months following the IPO is a crucial indicator of market sentiment.

Market Capitalization:

The market capitalization of the company reflects its overall valuation based on the stock price and outstanding shares.

IPO Success Rate:

The success rate of IPOs can vary based on market conditions and investor appetite.

Post-IPO Challenges:

Companies may face challenges in meeting market expectations, managing public relations, and adapting to increased scrutiny.

Famous IPO Success Stories

Numerous companies have experienced significant success after going public, witnessing substantial growth and market recognition.

IPO Risks and Considerations

While IPOs offer various benefits, potential risks and challenges must be carefully considered.

Market Conditions:

IPO success can be influenced by prevailing market conditions, investor sentiment, and economic trends.

Company Valuation:

Determining the right valuation for the IPO is critical to attracting investors while ensuring fairness.

Industry Trends:

Companies operating in rapidly changing industries should consider how market dynamics may impact their post-IPO performance.

Investor Sentiment:

Understanding and addressing investor sentiment can play a vital role in the IPO’s success.

How to Invest in IPOs

When it comes to investing in IPOs, it’s important to really think things through and have a good grasp of how the process works..

Through Brokers:

Individual investors can participate in IPOs through brokerage firms that offer access to new issues.

Eligibility Criteria:

Certain eligibility criteria, such as income and net worth requirements, may apply to IPO investors.

Investment Strategies:

Investors should develop a well-thought-out investment strategy based on their risk tolerance and financial goals.

IPO vs. Direct Listing

In recent years, direct listings have emerged as an alternative to traditional IPOs.

Differences and Benefits:

Direct listings differ from IPOs in terms of pricing, fundraising, and share allocation.

Popular Examples:

Notable companies like Spotify and Slack have opted for direct listings instead of traditional IPOs.

IPO Trends and Future Outlook

IPO trends are constantly evolving, influenced by market dynamics, investor preferences, and regulatory changes.

Conclusion

In conclusion, an Initial Public Offering marks a significant milestone in a company’s journey, offering access to capital and enhanced market reputation. However, it also comes with challenges such as increased regulatory compliance and loss of control for founders. Understanding the IPO process, performance metrics, and potential risks is crucial for investors considering participation in IPOs.

FAQs

1. What is an IPO?

An IPO, or Initial Public Offering, is a significant step for a company to become publicly traded. It involves offering shares to the public for the first time, allowing individuals to become shareholders and invest in the company’s growth.

2. How does an IPO benefit a company?

An IPO provides a company with access to a larger pool of capital. This funding can be used for expansion, research, development, and various strategic initiatives. Additionally, going public enhances the company’s market reputation and visibility.

3. What are the disadvantages of going public through an IPO?

While IPOs offer benefits, they also come with downsides. Founders might experience a loss of control due to increased shareholder influence. The company must adhere to strict regulatory compliance, and the pressure to meet short-term market expectations could impact long-term strategies.

4. How can investors participate in IPOs?

Investors can participate in IPOs through brokerage firms that provide access to new offerings. It’s important to meet any eligibility criteria set by the IPO, such as income or net worth requirements.

5. Are direct listings a better option than IPOs for companies?

Direct listings are an alternative to traditional IPOs. They offer differences in terms of pricing, fundraising, and share allocation. Some companies opt for direct listings based on their unique goals and circumstances.

Remember, understanding the ins and outs of IPOs is crucial for both companies considering going public and individuals looking to invest in these opportunities.