Introduction

In the realm of financial markets, the past week bore witness to a series of intriguing developments, with the Nifty 50 index at the forefront of attention. As the week unfolded, the dynamics of the equity landscape painted a complex picture of highs and lows, while various sectors played out their narratives against the backdrop of macroeconomic influences. Let’s delve into the details of this eventful week, dissecting the journey of the Nifty 50 and its implications for investors and market participants.

Week’s Performance and Sectoral Dynamics:

The week began with the BSE Sensex surrendering a substantial 439 points, culminating in a close at 65,721. Simultaneously, the Nifty 50 took a step back, retreating by 129 points and concluding the week at 19,517. This marked a departure from the bullish momentum that had been a defining feature of the preceding period. Notable among the sectors that grappled with downward pressure were automotive, banking, financial services, fast-moving consumer goods (FMCG), and oil & gas. The gravitational pull was palpable, as these sectors encountered selling pressure that sent ripples through the market.

A counterpoint to this narrative was the technology sector, which exhibited signs of resilience. Witnessing buying activity, this sector played a crucial role in mitigating the overall losses experienced by the market. The technology sector’s ability to weather the storm underscored its importance as a stabilizing force in times of market turbulence.

Broader Market Movement:

Zooming out to assess the broader market scenario, it was evident that the Nifty Midcap 100 and Smallcap 100 indices charted a more favorable trajectory. With gains of 0.7 percent and 0.8 percent respectively, these indices showcased a resilience that hinted at a nuanced market landscape. This divergence from the Nifty 50’s performance was a reminder that the market is composed of multifaceted dimensions, each responding to its own set of influences.

Factors Behind the Decline:

As the week concluded, market observers sought to decipher the underlying factors that contributed to the persistent downturn. The convergence of multiple influences was evident, echoing the intricate dance between global and domestic events that shapes market sentiment.

One of the prominent triggers was the announcement of a credit rating downgrade in the US. This development sent ripples across global markets, creating an atmosphere of caution and prompting market participants to reassess risk profiles.

Foreign institutional investors (FIIs) emerged as key players in the unfolding drama. Their substantial sales signaled a response to rising US bond yields, a trend that added to the uncertainties surrounding market dynamics. The correlation between FIIs’ actions and US bond yields showcased the interconnectedness of global markets and the far-reaching implications of macroeconomic shifts.

Adding to the mix were disappointing manufacturing data from China and the Eurozone. These figures served as a reminder of the intricate web of global trade and the susceptibility of markets to fluctuations in economic performance on a global scale.

Anticipating the Road Ahead for Nifty:

As the week drew to a close, market participants turned their gaze towards the forthcoming week, armed with anticipation and cautious optimism. All eyes were on the Reserve Bank of India (RBI) and its impending decision on interest rates. This decision was poised to have far-reaching consequences, potentially setting the tone for market fluctuations within a broad range and an increased measure of volatility.

Experts, meanwhile, viewed the prevailing circumstances as an opportune moment for investors to capitalize on gains following the recent market upswing. The dichotomy between caution and opportunity underscored the delicate balance that investors often tread in times of uncertainty.

Market Outlook and Insights:

Analyzing the trajectory of the Nifty 50, it was evident that the week had imparted crucial insights into the market’s behavioral patterns. Observers concurred on the likelihood of the market maintaining a rangebound pattern characterized by oscillations. This forecast mirrored the ebb and flow of market sentiment, underlining the potential for transient peaks and troughs in the weeks to come.

The RBI’s interest rate decision loomed large in this narrative, serving as a pivot point that could influence market sentiment and trajectories. This juncture reflected the delicate dance between policy decisions and their resonance within the market.

Simultaneously, the ongoing conclusion of the quarterly earnings season occupied a central role in shaping stock-specific movements. This highlighted the intricate interplay between company performance, investor expectations, and broader market dynamics.

Technical Analysis:

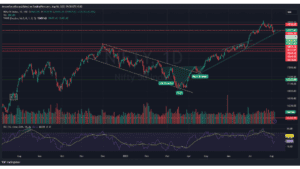

Turning to the technical aspects of the Nifty 50’s performance, the week’s conclusion saw a noteworthy recovery. The index surged by 135 points, leaving an indelible mark on the charts. On the daily chart, a modest positive candle emerged, adorned with marginal upper and lower shadows. This visual representation mirrored the resilience demonstrated by the Nifty 50 in the face of challenges.

Contrastingly, the weekly chart told a different tale. A red candle dominated the canvas, featuring a substantial upper wick and an elongated lower wick. This portrayal captured the volatility that marked the week’s journey and offered a visual representation of the forces at play.

A significant moment of analysis was the convergence of the hourly momentum indicator at the equilibrium line. This inflection point held a mirror to the potential maturation of the rebound phase and signaled the prospective initiation of a fresh downward cycle. This assessment resonated with the insights shared by Nagaraj Shetti of HDFC Securities, adding depth to the technical analysis.

Price Dynamics and Key Levels:

Throughout the week, the Nifty 50 charted a distinctive trajectory, showcasing its resilience in the face of challenges. A gap-up opening of 20 points set the tone for the week, with the index finding support from the 20 SMA at the 19,600 level. This support acted as a launching pad, propelling the index to ascend on Tuesday. Efforts were then directed towards sustaining the 19,700 level, emblematic of the tug of war between market forces.

Wednesday, however, introduced a bearish gap-down opening of 80 points. This event proved pivotal, leading to the breach of the critical support level at the 20 SMA (19622). The breach carried far-reaching implications, as it triggered a substantial 200-point slump, setting the stage for Thursday’s close at 19,526.

This downward trajectory persisted until the Nifty 50 encountered a steadfast support level at 19,300. A historical pillar of stability, this level played a crucial role in stemming the tide of bearish momentum. Friday heralded a gap-up initiation of 80 points, culminating in a close at 19,517. This upward surge hinted at the Nifty 50’s ability to harness resilience even in the face of challenges.

RSI and Sentiment Analysis:

A nuanced understanding of market sentiment was derived from the analysis of Relative Strength Index (RSI) levels. On the daily chart, the RSI hovered at 52 levels, painting a picture of equilibrium between bullish and bearish forces. This state of balance highlighted the indecision that characterized the week’s trajectory.

The weekly RSI, however, struck a different chord. With levels at 68, it reflected a more bullish sentiment over a longer timeframe. This duality of sentiment mirrored the broader narrative of the market’s dance between uncertainty and opportunity.

Support and Resistance Levels:

The journey of the Nifty 50 was punctuated by key support and

resistance levels that held sway over its trajectory. The 19,300 level emerged as a bastion of support, stemming the tide of bearish momentum. A breach of this level could potentially pave the way for a swift descent toward the 19,000 mark, underscoring the significance of these inflection points.

Conversely, a prominent resistance level materialized at 19,800, presenting a hurdle for the index to overcome. This level represented a challenge to the Nifty 50’s upward momentum, encapsulating the interplay between market forces and levels of psychological significance.

Derivative Market Insights:

An additional layer of insight was drawn from derivative market indicators. Call Option writers held prominence at the 19,600 level, suggesting a concentration of sentiment that could influence market behavior. Conversely, significant Put Option writers were positioned at the 19,400 level, shedding light on another key inflection point that resonated within the market ecosystem.

In Conclusion:

The week’s journey of the Nifty 50 presented a microcosm of the intricate interplay between macroeconomic influences, technical dynamics, and investor sentiment. The resilience displayed by the technology sector, the divergent paths of sectoral indices, and the ebb and flow of support and resistance levels collectively painted a canvas that encapsulated the complexities of financial markets.

As the forthcoming week beckoned, the spotlight shifted to the RBI’s interest rate decision, promising to introduce a fresh wave of volatility. Investors, armed with insights and cautious optimism, navigated the tightrope between uncertainty and opportunity, carving a path through the intricate tapestry of market dynamics. The Nifty 50’s journey stood as a testament to the multifaceted nature of financial markets, offering a mirror to the ebbs and flows that define this intricate landscape.

Pingback: Strategic Insights: Empowering Bank Nifty Predictions for a Profitable Week Ahead - Finance By Chance1

Pingback: Strategic Insights: Empowering Nifty Predictions for a Profitable Week Ahead - Finance By Chance1