Financial Planning Tips: Creating a Solid Financial Plan That Works

In our rapidly evolving world, the art of managing your finances has never been more crucial. Whether you’re saving for a big purchase, trying to get out of debt, or simply aiming to gain better control over your money, having a set of Financial Planning Tips can be the key to success.

Understanding the Importance of Financial Planning

Financial planning isn’t about restricting your spending; it’s a strategic tool that empowers you to achieve your financial goals. It provides you with a clear picture of your income and expenses, helping you make informed decisions about where your money should go. Without a well-thought-out financial plan, it’s easy to overspend, accumulate debt, and miss out on opportunities to save and invest wisely.

Setting Clear Financial Goals

The foundation of any effective financial plan is setting clear and achievable goals. Whether your aim is to buy a new home, fund your child’s education, or build an emergency fund, having specific goals will give your financial plan purpose and direction. For this article, we’ll focus on sharing Financial Planning Tips to help you plan a dream vacation to Hawaii.

Crafting Your Financial Plan

Now that you have your financial goals in mind, it’s time to create a financial plan that aligns with your objectives. Here’s a step-by-step guide on how to do it, incorporating essential Financial Planning Tips along the way:

1. Calculate Your Monthly Income

Begin by determining your monthly income. This includes your salary, bonuses, rental income, and any other sources of revenue. One of the crucial Financial Planning Tips to remember is to accurately assess your income.

2. List Your Monthly Expenses

Next, it’s time to roll up your sleeves and put together a comprehensive list of all your monthly expenses. This is where you get down to the nitty-gritty of your financial life, and it’s a crucial step in crafting a budget that truly reflects your reality. Take a deep dive into your spending habits, leaving no stone unturned. Your goal is to capture every single expense, both big and small, so you can get a clear picture of where your money is going each month. Categorize them into fixed (e.g., rent, utilities) and variable (e.g., groceries, entertainment) expenses. It’s one of the essential Financial Planning Tips to ensure that you account for all your expenses.

3. Analyze Your Spending Habits

Take a close look at your spending habits and carefully pinpoint areas where you can trim down your expenses. This involves conducting a detailed examination of your monthly outflows and discovering potential areas where you could reduce your spending. By doing so, you’ll be able to free up more of your hard-earned money for the things that truly matter to you and your financial goals. This might include dining out less, canceling unused subscriptions, or finding more affordable insurance options. Financial Planning Tips dictate that this step is crucial in optimizing your budget.

4. Allocate Funds Thoughtfully

Allocate a portion of your income to each expense category, ensuring that your expenses do not exceed your income. Prioritize saving for your Hawaii vacation within this section, as per the Financial Planning Tips shared earlier.

5. Regular Monitoring and Adjustments

One of the most important Financial Planning Tips is to consistently monitor your spending and compare it to your budget. If you notice any discrepancies or overspending, make adjustments as needed to stay on track with your Hawaii vacation fund and other financial goals.

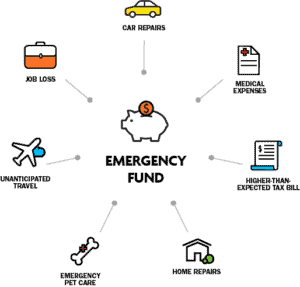

Building an Emergency Fund

Life is full of unexpected surprises, and having an emergency fund is one of the critical Financial Planning Tips to provide you with peace of mind. Ensure you allocate a portion of your budget toward this fund, as it serves as a financial safety net.

Tackling Debt Wisely

Debt often stands as a formidable barrier on the path to financial freedom, casting a shadow over one’s financial well-being and future aspirations. It can be a heavy burden that restricts your ability to make choices, save, and invest for your dreams. Implement the Financial Planning Tips provided earlier to strategize for paying off debt, such as the snowball or avalanche method. Highlight how eliminating debt can free up more funds for your Hawaii vacation and other financial aspirations.

Saving and Investing for the Future

Once you’ve established a budget and are on track with your financial goals, it’s time to consider saving and investing. Here, it’s crucial to remember the Financial Planning Tips about exploring various savings accounts, investment options, and understanding potential returns on investment to maximize your financial growth.

In Conclusion

In conclusion, creating a financial plan is a crucial step toward achieving your financial dreams, such as that dream Hawaii vacation. By setting clear goals, creating a well-structured budget, building an emergency fund, paying off debt wisely, and strategically saving and investing, you’ll be well on your way to financial success.

Remember, financial planning is not a one-time task but an ongoing process. Consistently review and adjust your financial plan as your circumstances change. With discipline, determination, and a well-executed plan filled with valuable Financial Planning Tips, you can turn your financial dreams into reality.